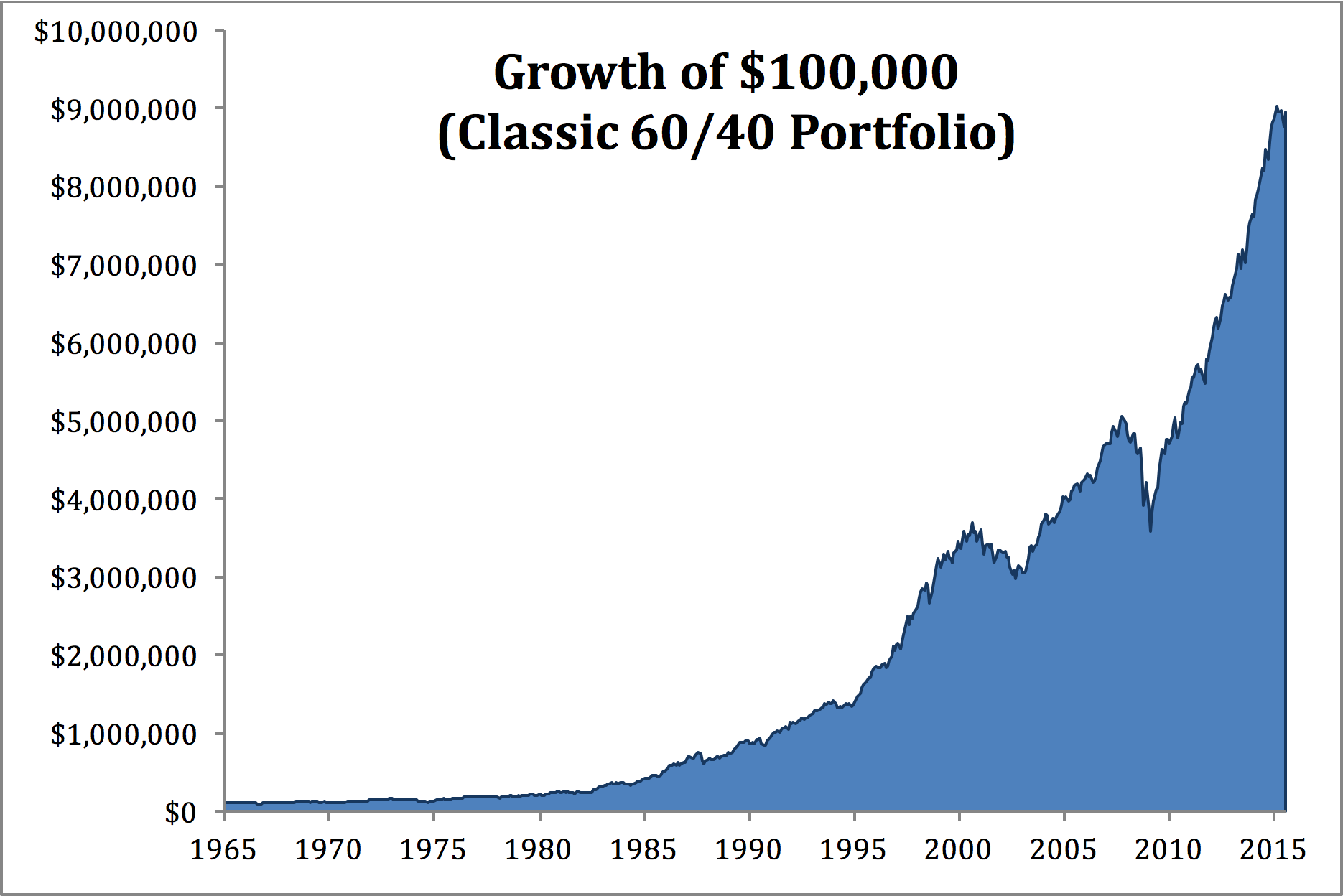

Investors who follow a carefully planned set of guidelines have a higher success rate than those who act on their emotions or make frequent changes based on the events of the day. Our investment committee spends the majority of its time researching and writing about how to utilize behavioral finance in concert with the best practices in portfolio management. We have designed an investment approach that allows us to capitalize on the long-term, while not allowing temporary activity in the markets to interfere with our decision-making process.

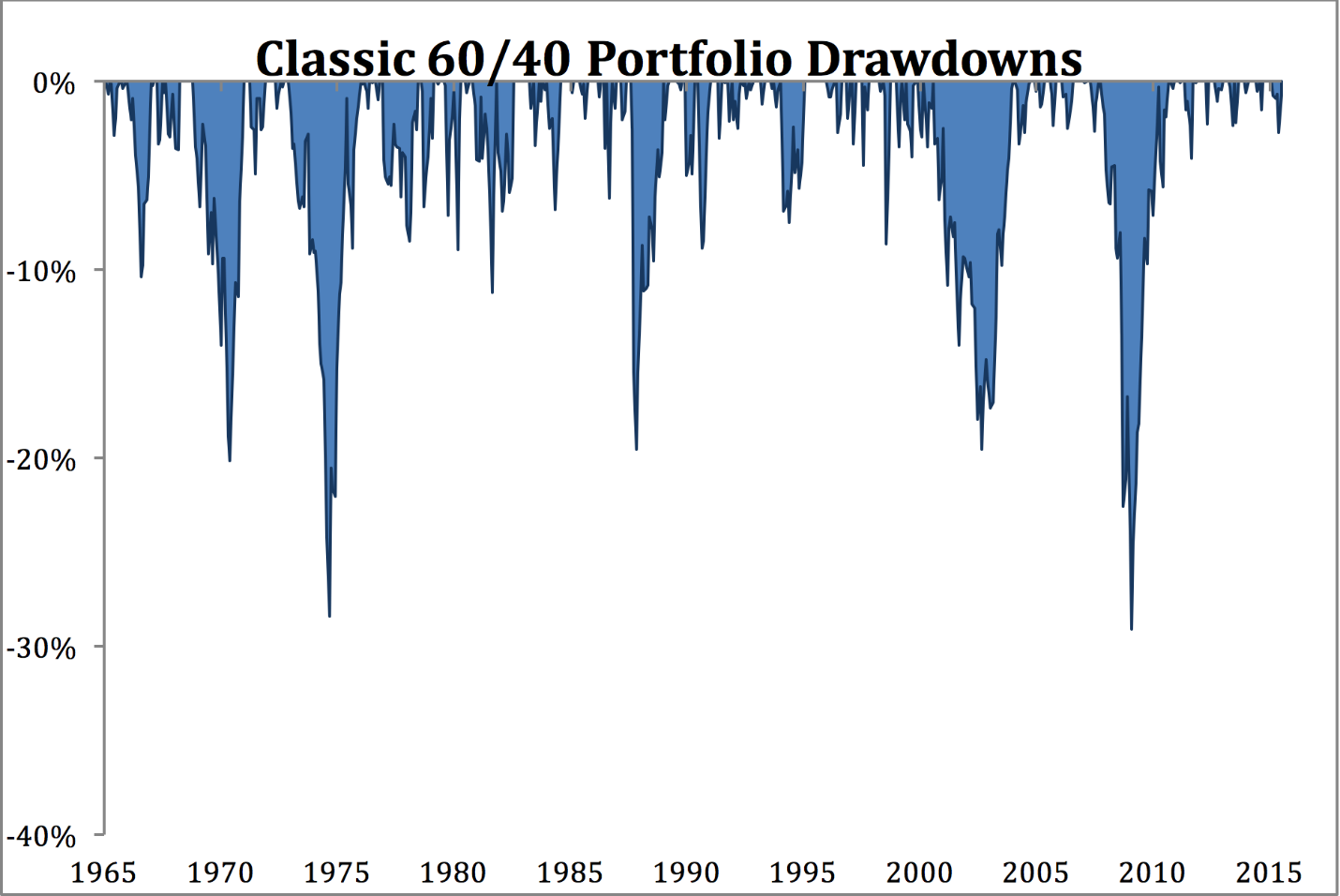

Two of the central tenets of our investment process are portfolio construction and risk management. We believe that thinking and acting for the long-term is paramount; this idea is at the heart of our client service and portfolio management program. Behavioral counseling, a balanced investment plan and consistent communication are the tools we employ to help our clients utilize “time arbitrage” to their advantage.